An op-ed by Steffany Bahamon, Jasmine Omeke and Steven Vance (Abundant Housing Illinois co-leads) published in Crain’s Chicago Business.

Of all the major cities in the United States, Chicago provides the greatest value, with robust amenities and culture without correlated housing costs. But if Chicago wants to retain that status, some things need to change. Rents in Chicago are growing faster than the country’s average, and the inventory of housing for sale in the Chicago area is at an 11-year low. In September, Redfin published data showing asking rents had increased 11% year over year. New construction is lagging, too. When we look at new homes permitted per year in Chicago, we see a sharp drop in the number of permits for detached houses and multifamily buildings in the last three years.

There isn’t enough housing available for the new households moving into Illinois or relocating between cities and neighborhoods. Plus, households today have fewer people, requiring more homes to support the population. The Illinois Economic Policy Institute estimates the state is short 142,000 homes. Recent Census Bureau data shows that Chicago hit a demographic milestone: The city now has more households than ever before, even compared to 1960, when the city had about 1 million more inhabitants.

Compounding the problem is that people’s incomes are not keeping up with rents. In Cook County, wages went up 4% from 2024-2025, and across Illinois they went up only 3.2%.

Household growth and rising rents are clear indicators of demand and evidence of the need for more homes. By increasing the housing supply, Chicago can maintain an affordability that both entices people to live here and makes it practicable to do so. No amenity or cultural offering can compensate for an inability to make ends meet, and a failure to anticipate growth prohibits growth.

The climbing cost of housing is a main reason why 450 people have joined Abundant Housing Illinois, and bringing down costs is why they help in the political fight to show there is support for more housing. In 2025 about 50 Abundant Housing Illinois volunteers from Chicago and Champaign traveled to Springfield on multiple occasions to meet their legislators and talk about this statewide housing shortage. We specifically advocated for HB 1813 and HB 1814, two bills introduced in the state Legislature that would have permitted accessory dwelling units (ADUs), like granny flats and coach houses, across Illinois and two-, three-, and four-unit houses in many municipalities, respectively.

Our volunteers, most of whom live in Chicago and want to stay in Chicago, will again support these, and other bills, in 2026. These two bills, which are necessary to reduce — and yet still insufficient to ameliorate — the housing shortage, did not get approved.

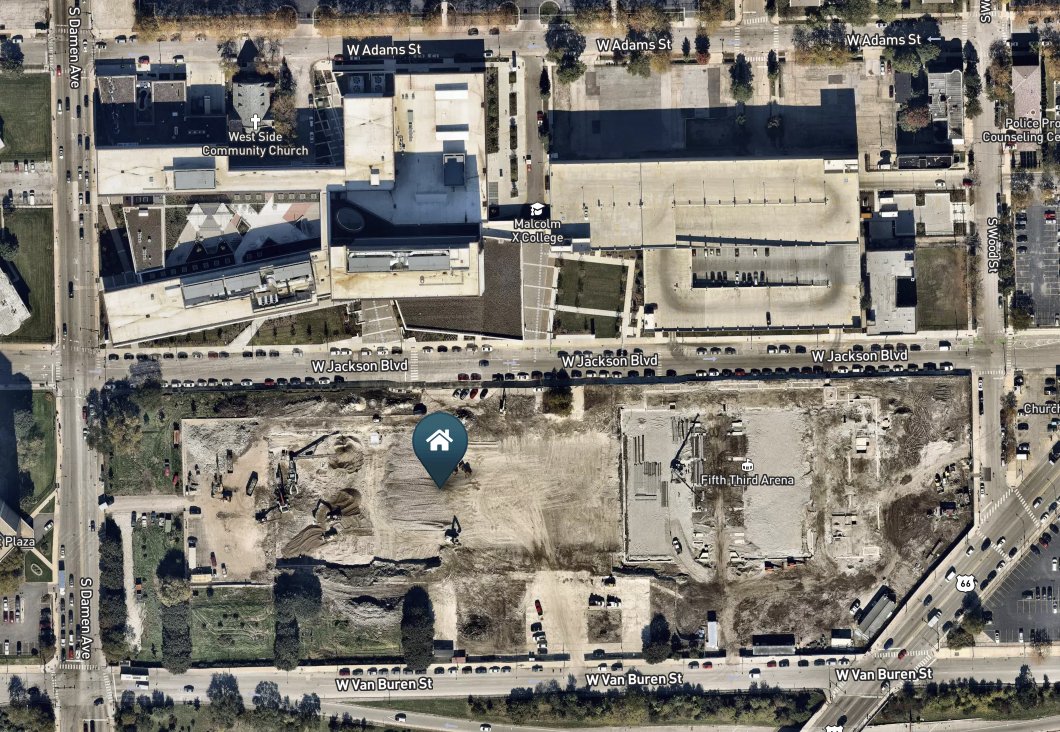

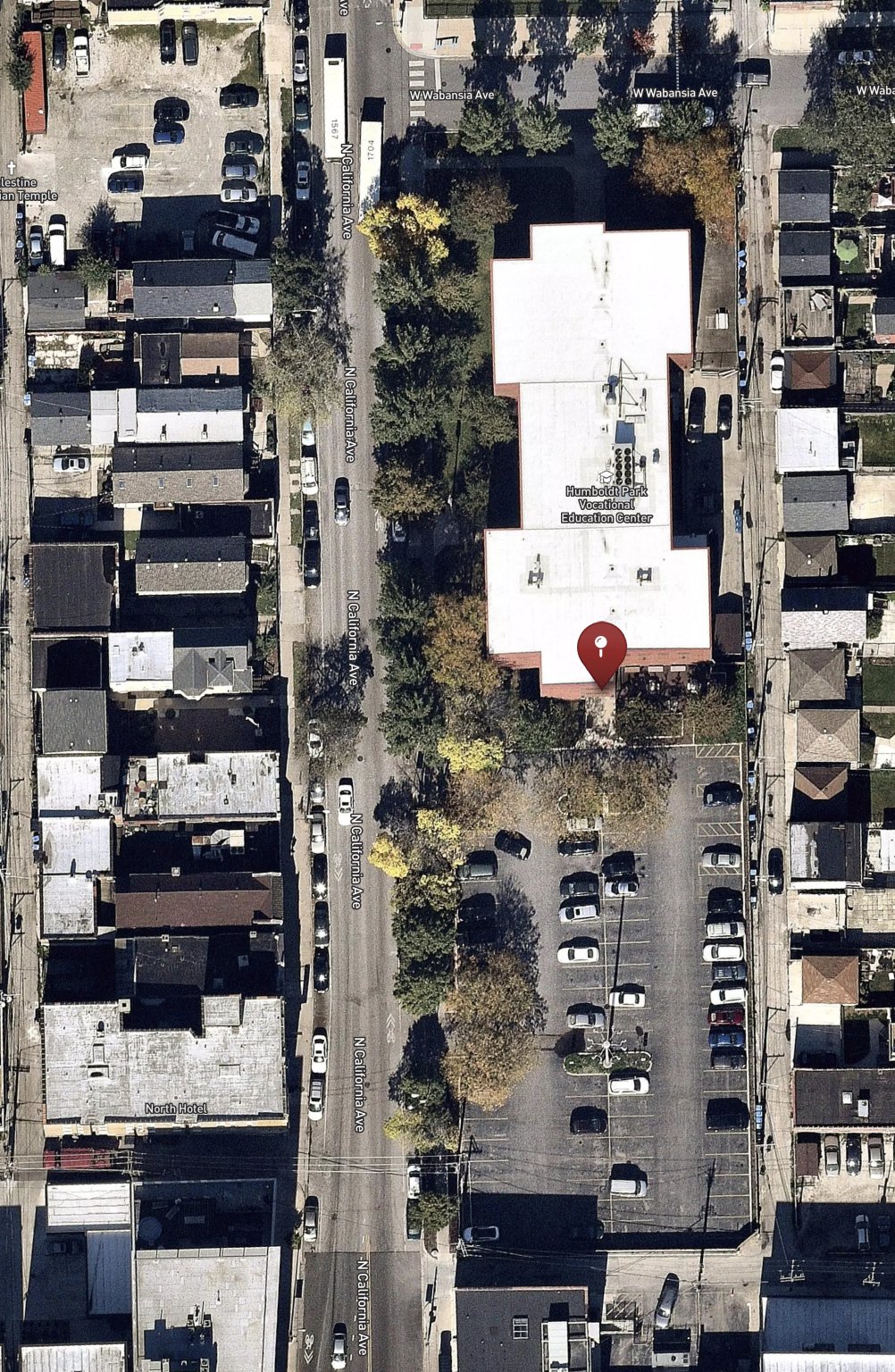

And it’s clear that action needs to happen at the state level because the problem is broader than any one city. The Chicago market for home prices extends across the suburban border, where home prices are also increasing at a similar rate to the city average. Chicago can take unilateral action on housing within its borders. Starting last year, some alderpersons have collaborated with the city’s planning department to proactively upzone neighborhood corridors — on all sides — to allow more housing and allow it to be built sooner. And in September, the City Council adopted a permanent ADU program.

Organizing a sufficient response from the multitude of governments across the Chicago metropolitan area to allow enough housing at the rate that it’s needed is much more difficult. Still, even more permission for new housing isn’t enough. Additional reforms are also necessary everywhere in Illinois: standardizing which fees are assessed and in what amounts; curbing delays and additional costs from project-by-project exactions for perceived impacts that aren’t based on empirical standards; and amending building code requirements, like not always requiring a second stairway, as Seattle and New York City have been doing for decades.

We’ll see legislators in Springfield in the spring to fight for these reforms again. Growth in and around Chicago is counting on them.